Module 1: Agreeing on the Estimate

The reconstruction estimate

Your reconstruction estimate is essentially the scope of work for your home’s repair. Because this document determines how much your insurance pays, it is important that you take the time to understand it. Here’s a breakdown of how to navigate it:

The Negotiation Process

It’s common for your contractor and your insurance adjuster to have different totals. Don't panic—this is very typical and the starting point for negotiation.

The Goal: Find a middle ground where the insurance pays enough to cover the actual costs. Ideally your contractor will spearhead this effort as they are most knowledgeable about what needs to be included in the estimate.

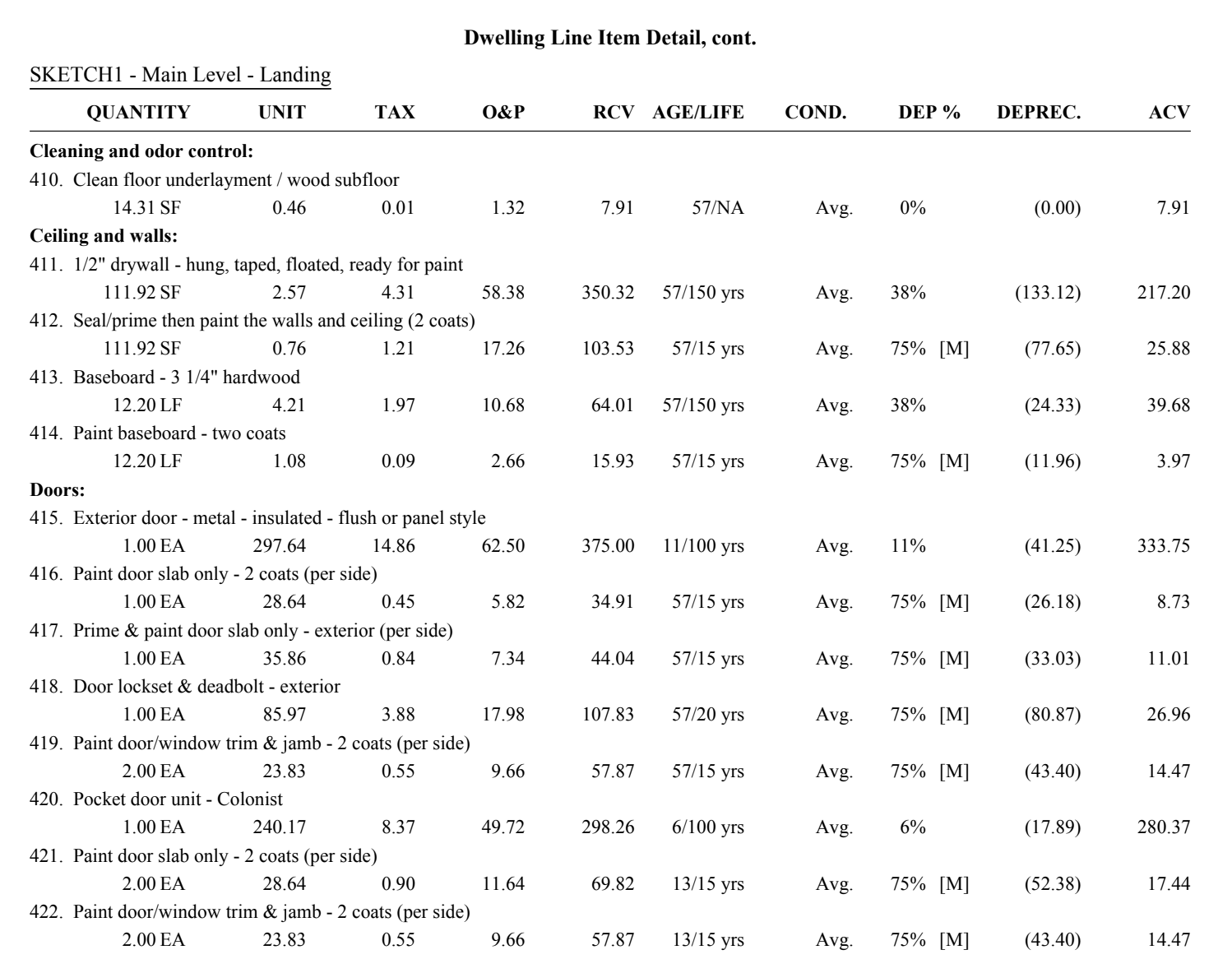

The Tool: If both your contractor and insurance adjuster use Xactimate to create their estimates, that will help to be able to compare the line items. Xactimate breaks down the estimate by room and typically includes a floor plan at the end of the estimate. You will want to make sure that the line items in each room include all the work to be done.

Example of an insurance adjusters Xactimate estimate

Reviewing the Details

Read through the estimate room-by-room to understand what is included in the work. If a floor is being replaced, the insurance adjuster’s estimate likely has one line item:

R&R (remove and replace) floor

While that is accurate, it is missing some details. Your contractor’s estimate should include:

Remove existing floor

R&R damaged subfloor

Install hardwood flooring

Sand, stain, and finish wood floor

Install base board

Stain and finish base board

Install base shoe or quarter round

Stain and finish base shoe or quarter round

You can see the contractor’s estimate would include way more information and typically a higher cost. Your contractor is your best ally here. They know the "hidden" steps and construction methods that an adjuster might overlook.

Handling Additional Work with Supplements

Construction almost always reveals hidden damage. For example, once the shingles are off, your contractor might find a few more damaged wood trusses that were invisible before. Supplements are very common as it’s practically impossible to account for every cost on a building project before you begin.

When this happens, you submit a Supplement to the insurance company

What it is: A separate estimate for the extra work found after the project started.

How it works: You or your contractor submit the new costs to the adjuster. As long as you haven't hit your total policy limit, the insurance company should approve and pay for these additions.

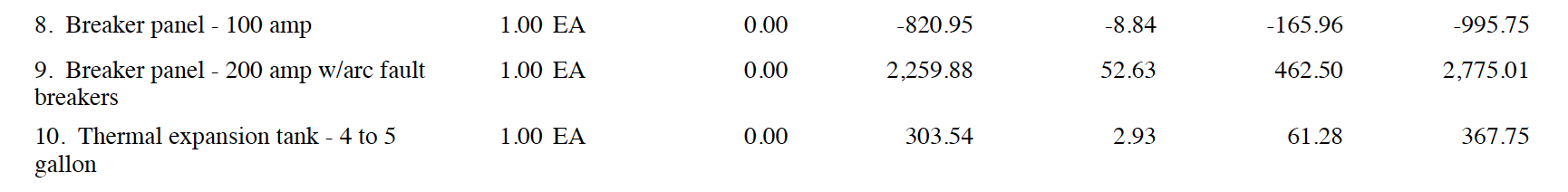

Building ordinance or code upgrades

This is a separate bucket or policy limit that is used just for code upgrade items. Your contractor will have to provide a separate estimate to the insurance adjuster just for these items. The tricky part is that this bucket only covers the difference in the cost for bringing something up to code. For example, let’s say your house previously had a 100 amp electrical panel, but the code now requires a 200 amp panel. Your main rebuilding estimate will include the cost for 100 amp panel and your code upgrade estimate will include the difference between the cost of the 100 amp and 200 amp panel. You can see how this looks in the example below:

In this code upgrade estimate, the 100 amp panel is shown as a deduction (because it was on the main rebuilding estimate) and the 200 amp panel as the additional cost. So when you do the math on this estimate, the total code upgrade cost for the new 200 amp panel would be $1,779.26 ($2,770.01 - 995.75).

And some items could just be a straight up additional cost, like the thermal expansion tank in this example estimate.

Managing the construction process