Module 2: Proving Your Loss - Ownership and Damage

Proving you owned it

We have noticed in the last few years that insurance companies have been making it harder for people to prove they have lost items. Whether a fire completely destroyed your personal property or a tornado blew it across town never to be seen again, it seems unreasonable that the insurance companies are putting the burden on you to prove you once owned these things. But it’s happening.

Here are a few ways to help prove what was in your home:

Dig through social media: Look for old photos of family gatherings or holidays that might show your furniture or electronics in the background.

Ask friends and family: Reach out to people who have visited recently; they may have pictures or videos on their phones that show your belongings.

Use the "Reasonableness" argument: Point out to your adjuster that it is logical to assume a family has more than one TV or someone owns multiple pairs of shoes.

Challenge unrealistic demands: Remind the adjuster that it is impossible to have receipts for every single item when those very documents were destroyed in the disaster. And since every case is different, the same requirements cannot be applied across the board and should be treated on an individual basis.

Proving it needs replacement

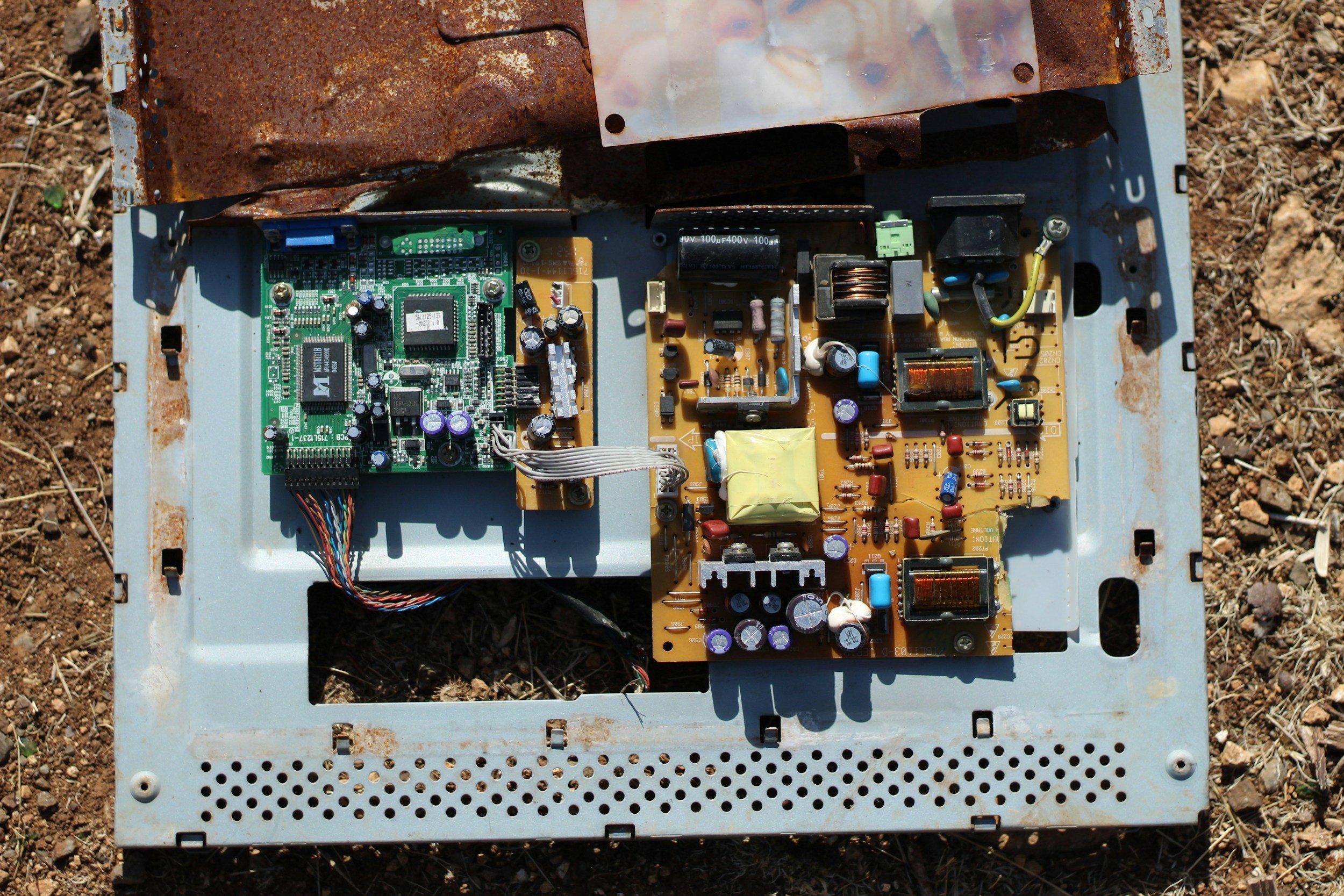

On the other end of the spectrum, we have also seen insurance companies demand proof that something is damaged beyond repair and needs to be replaced. This most commonly happens with electronics and large appliances like washers and dryers.

When items that contain electronics are exposed to smoke or water, they are typically unsafe to salvage, even if they look ok. Heat can melt internal parts, smoke carries acidic residue that can corrode electrical components, and water can cause short-circuiting. But your insurer may still require an inspection from a third-party repair shop to "officially" declare them a total loss. This usually looks like taking the item to an appliance or computer repair shop.

In addition to being a time-consuming hurdle during an already busy recovery, these inspections represent an extra cost that you shouldn't have to carry. Be sure you confirm your insurance company is paying for these inspections and it isn’t coming out of your pay out.