Module 1: Unresponsive Adjusters and Delays

You’re not the only one

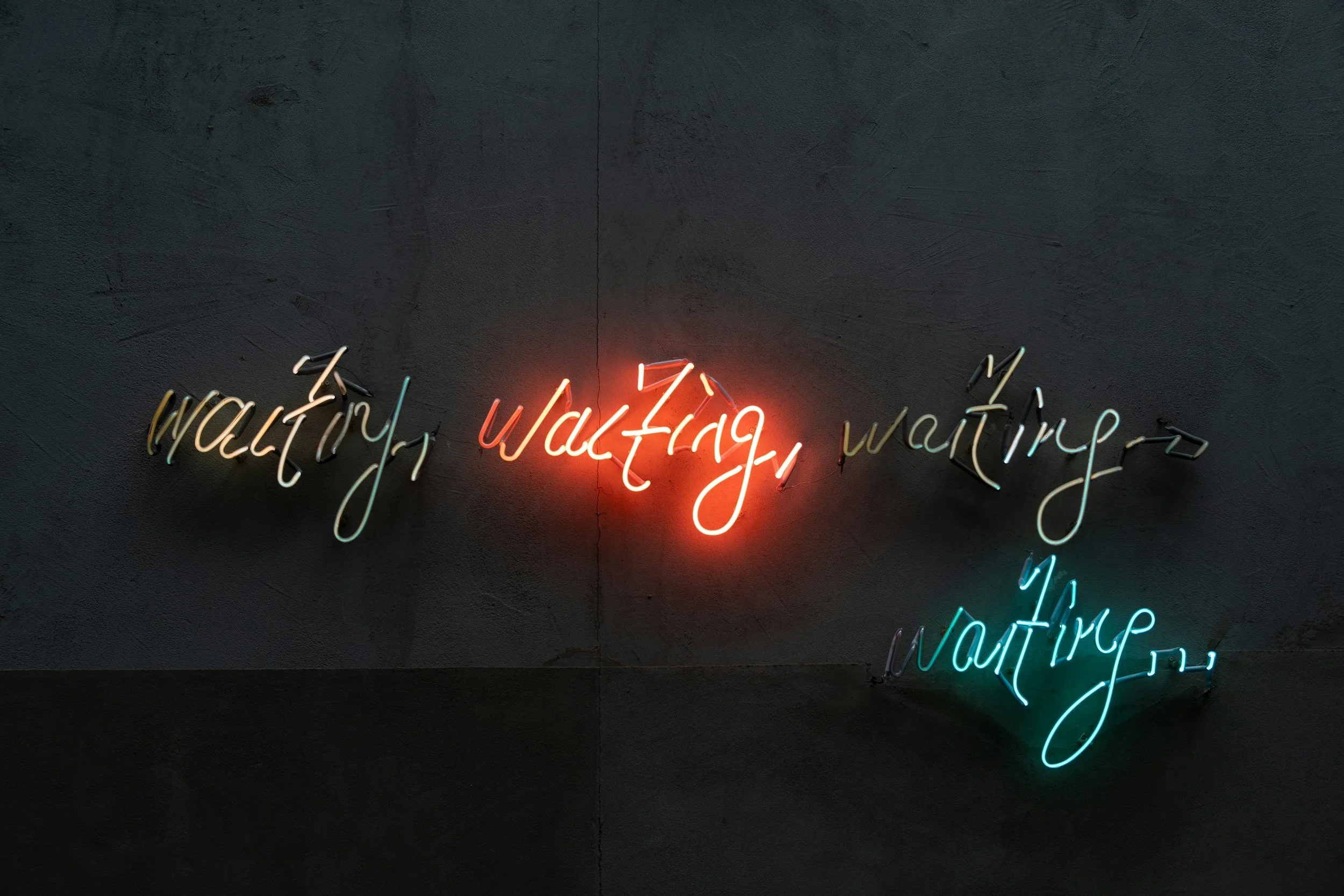

Communication delays are one of the most common complaints we hear from clients, and it can often feel as though your adjuster is intentionally ignoring emails or only returning calls at inconvenient times. While we have strategies below to help you combat this, please know that this friction is a known industry phenomenon called "sludge"—a term for a process designed to be so frustrating and repetitive that you eventually feel like giving up.

While not every adjuster is acting with bad intentions, understanding that there is a literal name for this tactic can help you realize that the struggle isn't your fault and shouldn't be taken personally. And we are here to support you so you don’t give up.

Ask for a supervisor

If you aren't getting a response from your adjuster, a good first step is escalating the issue to a supervisor which can often be enough to get things moving.

Here is a simple strategy to handle this:

Find the right contact: If your adjuster is silent, call the main claims line and ask for their supervisor’s name and contact details.

Document the friction: Ask the representative to add a note to your official claim file explaining that your calls and emails have gone unanswered. Insurance companies have centralized systems so that anyone can access your file, so use that to your advantage to make sure your complaints are documented.

Request a fresh start: Don't be afraid to ask the supervisor for a new adjuster. It is very common for adjusters to change during a claim, so it is a perfectly reasonable request if your current one isn't working out.

Here is an example email you can download and use to send your adjuster requesting an update and their supervisor’s contact info.

File a complaint

If you feel stuck or mistreated, remember that you have an advocate: your state’s Department of Insurance. Every state has one, and they allow you to file a formal complaint to help resolve disputes with your insurance carrier. While the level of enforcement varies by state, their goal is to engage with the company to find a resolution.

To make your complaint as strong as possible, follow these steps:

Gather your evidence: Provide a clear timeline of every email sent and call made or a history of your issues and lack of resolution.

Be detailed: The more documentation you have to support your claim, the easier it is for the state to step in. Don’t hesitate to include copies of emails or text chains.

Follow up: If you don't hear back, reach out to get a specific point of contact for your case so you can stay updated on their progress.

To file a complaint: Click the button below to find your state’s Department of Insurance. Scroll down to “File a Complaint” and select your state.

The last resort

If you’ve tried everything and your claim is still stalled, mentioning legal action is often the final step before actually hiring an attorney. Most states have "bad faith" laws that prohibit insurance companies from unreasonably delaying or denying your payments.

Here is what you should know about this stage:

The "Second to Last" Step: Sometimes, simply stating that you are prepared to involve a lawyer is enough to get a response.

The Final Step: Hiring an attorney is your last resort for getting the insurance company to comply.

Recovering Costs: If you go to court and win, many state laws allow you to recover what you were owed by the insurance company and possibly even your attorney fees and court costs from the insurance company.

Get a Template: While Our Front Porch are not attorneys and cannot provide legal advice, we can provide a letter template specific to your state’s laws to help you send a formal notice to your adjuster. Just give us a call.

Proving your loss: ownership & damage