Module 3: Should you Rebuild or Sell?

Understanding your options

Rebuilding is a huge undertaking, and it isn’t the right choice for everyone. Many people don’t realize that most insurance policies allow you to take a payout and sell the property instead of rebuilding.

If you choose not to rebuild, here is how the math usually works:

The Payout: You typically receive the Actual Cash Value (ACV). This is the total cost to rebuild your home minus "depreciation" (the value lost due to the age and wear of the house).

What you give up: You only get the depreciation money back after a rebuild is finished. If you sell, you lose that portion of the insurance money.

The Strategy: To get the most money possible, you need a very detailed rebuilding estimate. The higher the initial estimate, the more money you’ll walk away with—even after the insurance company subtracts for depreciation.

Next Steps:

Check your policy: Make sure your specific plan allows for this option.

Potential Buyers: There are often investors who are willing to buy damaged properties at a less than market rate value. Ask around to get an idea of what your property may be worth so you can weigh your options.

Think it over: There are many great reasons to sell rather than rebuild. Take your time to decide what works best for you.

Questions to ask yourself

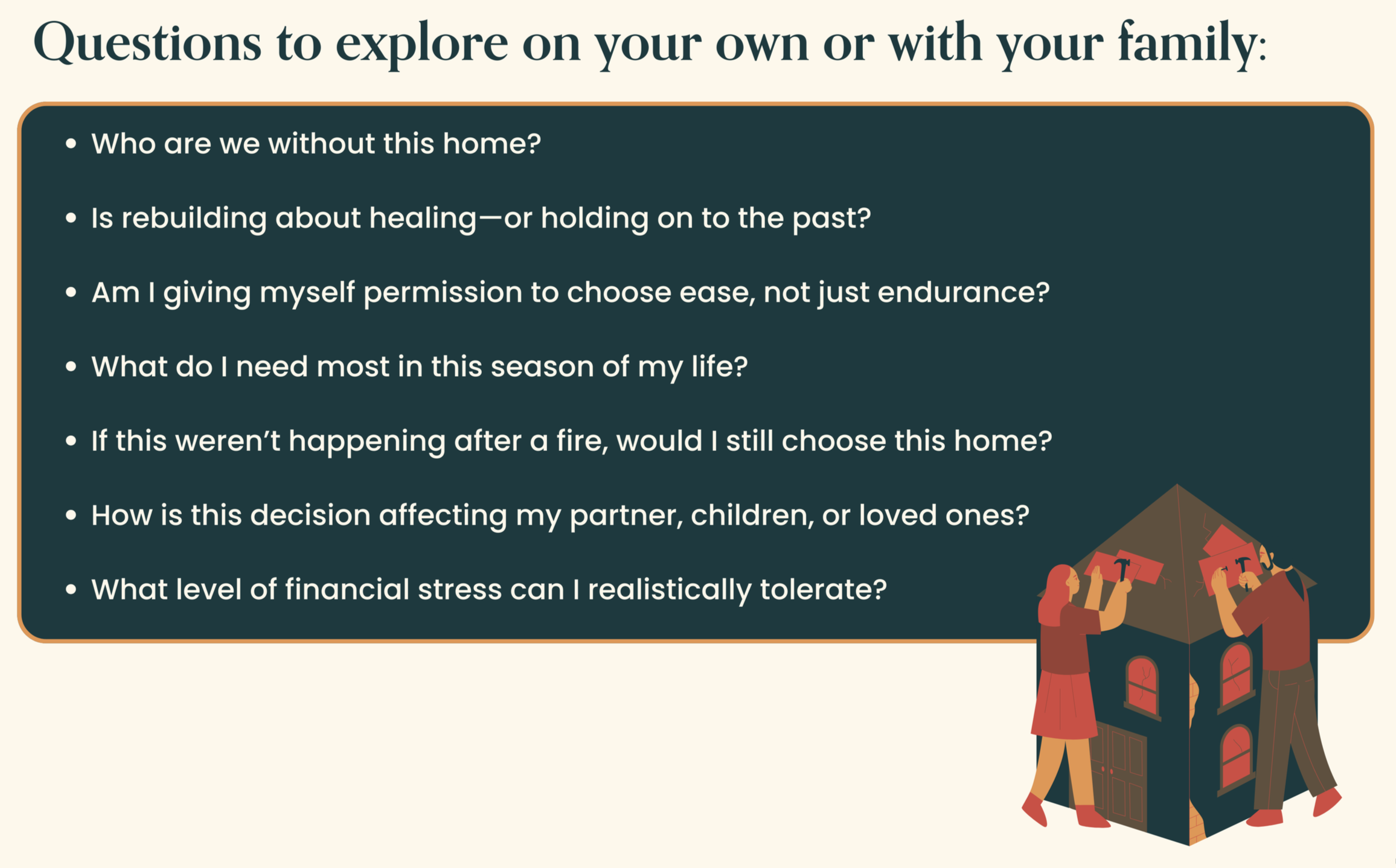

After a disaster, deciding whether to sell your home or stay and rebuild can raise many questions. Many people feel emotionally stressed, financially strained, and overwhelmed by logistics—all at once. If you’re experiencing this, you’re not alone. These questions are common, and ultimately, only you and your family can decide what feels right.

Here are some of the concerns people often face when making this decision:

Emotional questions

Your home may no longer feel the way it once did. Letting go can feel like losing a part of your life story. You may also wonder whether rebuilding will help you heal—or if it will keep the trauma of the fire close to the surface.

Decision fatigue and rebuilding fatigue

There are so many unknowns. What will the full scope of work be? Will insurance cover enough? How long will repairs actually take? How long will your family be displaced? Living with unanswered questions can be exhausting.

Financial Questions

You may be trying to figure out the gap between insurance and real costs. Should you sell as-is or wait? What does your mortgage look like compared to potential construction loans? Can you manage two housing costs at once?

Family and relationship questions

Concerns about stability—especially for children—often come up, like schools, routines, and emotional well-being. Partners may have different opinions about selling or staying, which can feel isolating or Fpainful. There’s also grief in saying goodbye to the life and milestones built in this home.

There is no single right decision. The right decision is the one that best supports your safety, stability, and capacity right now. Identity can be rebuilt, just like homes, but it takes time, gentleness, and support. You don’t need clarity yet for your experience to be valid.