Module 2: Proof of Loss & Mortgage Implications

What is Proof of Loss and how to fill it out

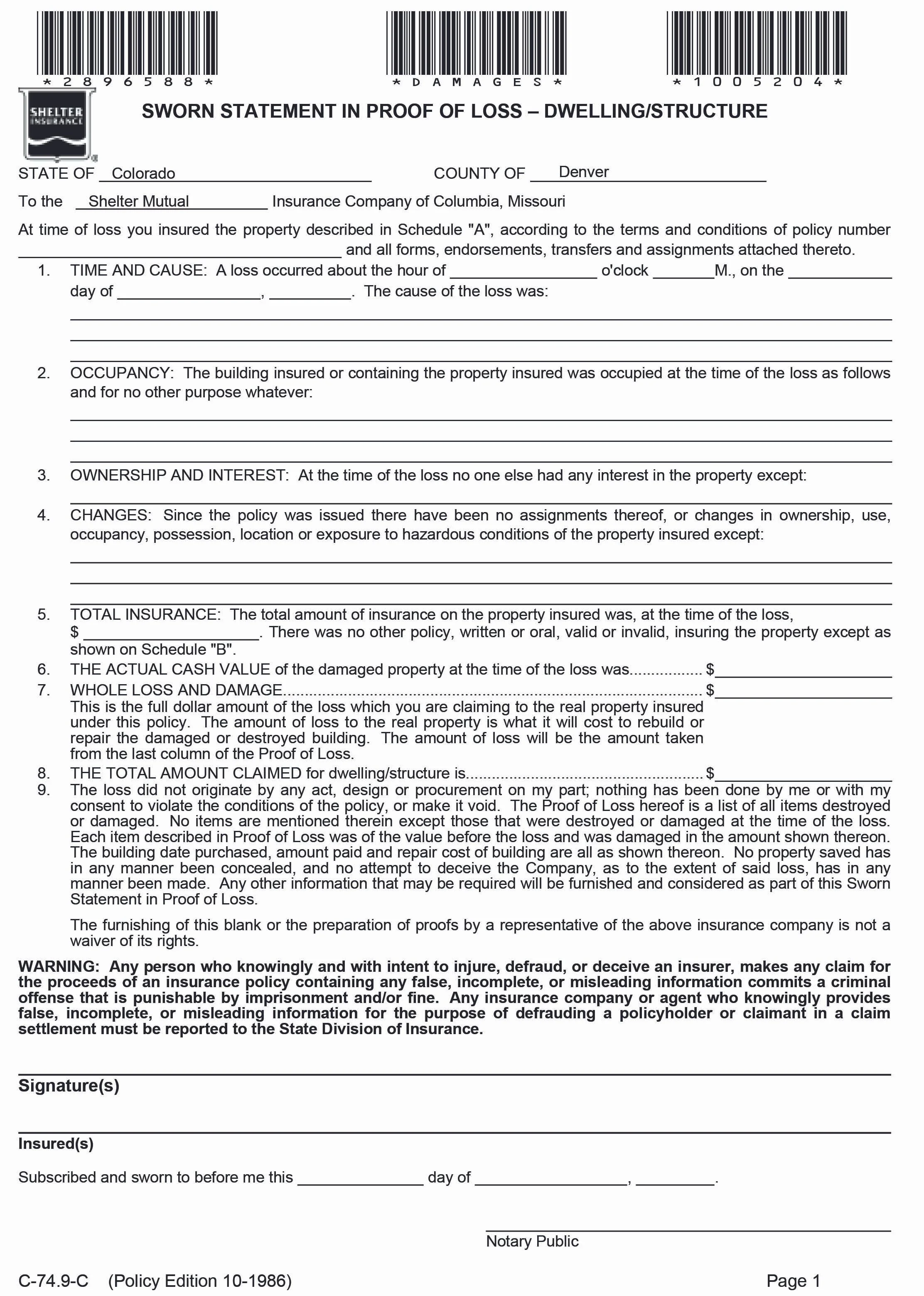

Proof of Loss is a common form that the insurance company will require you to submit as one of your responsibilities when filing a claim. The form will ask a series of questions about the loss, ownership of the property, and any changes since the insurance policy was issued. These questions are pretty straightforward, but the tricky part is that they also ask for the exact dollar amount of the damage. Since you're just starting the process, giving a final number right now is almost impossible! To make it tougher, they usually only give you about 30 to 60 days to turn it in.

But don’t let this stress you out. We’re going to help you get through it. Here is the best way to handle it:

Be honest: Since this is a sworn statement, you want to be accurate. If you don't know an exact number yet, it is perfectly okay to write "tentative," "pending," or "still determining."

Give context: If you're waiting on a professional, feel free to add a note like, "Contractor is still working on the estimate" or if your adjuster is moving slow, include "Waiting for the adjuster's inspection."

Ask for help: If a question feels confusing, email your adjuster and ask for a quick clarification. This way it is documented that you asked if they never respond.

Watch the clock: The most important thing is to submit it on time. You don't want to give the insurance company any excuse to delay or deny your claim just because of a missed deadline.

The role of your mortgage company

If you have a mortgage on your home, your lender is going to be a big part of the repair process. It might feel like an extra hoop to jump through, but since your mortgage required you to have insurance, the lender gets to be involved.

Since the bank technically has a financial stake in your home, they want to make sure the property is actually repaired and restored to its original value. Because of this, they are usually listed as a "payee" on your insurance checks. This means any checks you receive will be made out to both you and your mortgage company. Here’s how the process typically works:

Notification: Give your mortgage company a call and ask for the "Loss Draft" or "Insurance Claims" department. Let them know you’ve filed a claim.

The "Endorse and Send" Shuffle: When you get a check from the insurance company, you’ll sign it and mail it to the mortgage company.

The Escrow Account: The mortgage company will hold those funds in a special account and release the money in stages as the work gets done.

Verification: Before the mortgage company send out a payment for your contractor, they might ask for progress photos or send out an inspector to make sure the repairs are actually happening.

The Silver Lining: While this adds some paperwork, it can actually be a great safety net for you. If a contractor asks for too much money upfront or tries to cut corners, you have the mortgage company acting as a "middleman" to hold them accountable. They won't release the final payment until they're sure the job was done right.

But there is a limit to a lender’s involvement:

It is helpful to know exactly how much of your insurance money the mortgage company can "claim." Essentially, they are only entitled to the insurance money up to the amount you still owe on your loan. For example, let’s say you had a home fire and the estimate to rebuild is $500K. You have also owned your home for 20 years and have been slowly paying down the mortgage, so you only have $100K left that you owe on it. The mortgage company will only need to be a payee on the first $100K of your insurance funds, and the balance should go to just you. This is important so that you can keep the insurance money in your accounts and manage payment to contractors without having to wait for the mortgage company to release the funds.

The first conversation with your adjuster

Additional living expenses